regional income tax agency forms

The Income Tax Department also referred to as IT Department or ITD is a government agency undertaking direct tax collection of the Government of IndiaIt functions under the Department of Revenue of the Ministry of Finance. DFO-02 -- Personal Individual Tax Preparation Guide - For Personal Income Tax Returns PA-40.

How To File Your Taxes Online University Of Alberta International

If you want to avail income tax benefits on life insurance policies click the button below to get started in a few easy steps.

. DEX 93 -- Personal Income Tax Correspondence Sheet. You can notify the Tax Agency. Employers Quarterly Federal Tax Return.

Instructions for Form 941 PDF. Welcome to Ohios Regional Income Tax Agency RITA with a website designed to make your municipal tax administration service more easily accessible and navigable online. 2021 Individual Income Tax Information for Unemployment Insurance Recipients Form 1099-G reports the total taxable income we issue you in a calendar year and is reported to the IRS.

10 down payment is required Businesses. Youll need your Social Security number individuals or Federal Employer Identification Number. You can check the status of your Virginia refund 24 hours a day 7 days a week using our Wheres My Refund tool or.

PA-1 -- Online Use Tax Return. Wheres my Virginia Refund. If you end up with an expired IRS refund check youll need to apply for a replacement with the IRS.

Moreover the exemption would not be allowed on policy benefits received under a Keyman insurance plan under Section 80 DD 3 or under Section 80DDA 3 of the Income Tax Act 1961. As taxable income these payments must be reported on your state and federal tax return. Income Tax Department is headed by the apex body Central Board of Direct Taxes CBDT.

File Online Individuals who are ready to file a municipal income tax return or an exemption in one online session can file using FastFileNo login User ID or Password is necessary however you must be ready to complete your return or exemption in one session. DPO-86 -- File Your PA Personal Income Tax Return Online For Free With myPATH. The Regional Income Tax Agency RITA Agency has been serving Ohios cities villages and their taxpayers since 1971.

Main responsibility of Income Tax Dept. The tax on unrelated business income applies to most organizations exempt from tax under section 501a. We will inform you about the tax and help you prepare and file your income tax return.

The IRS website directs you to call 800-829-0922 or 800-829-3676 to order the forms and publications youll need to request a replacement check. Phone Call our Collections Department at 8043678045 during regular business hours to speak with a representative. Other aidallowance Aid of 200 euros.

Before downloading or requesting traditional personal income tax forms consider e-filing your PA Personal Income Tax Return with myPATH or PA e-file for faster processing. Individuals can file online at MyAccount by mail or in person. With forms tools and communication strategies that simplify and increase transparency we are helping individuals businesses and tax professionals navigate the.

Paper filed PA-40 returns can take 8-10 weeks from the date the return was mailed to post to the systemAdditionally it may take approximately 4 weeks for your return to be reviewed and processed. Is to enforce various. The site directs you to destroy the expired check but you should make a copy of the front and back of the check in.

Application forms to alleviate the harmful effects of the war in Ukraine. PA-19 -- PA Schedule 19 - Taxable Sale of a Principal Residence. 2020 Personal Income Tax Forms.

20 down payment is required Call our automated system Teleplan available 24 hours a day at 8044405100. Buy Insurance Plans Now. VAT returns types of schemes SII monthly refunds taxpayers obligations and other related procedures.

Employers who withhold income taxes social security tax or Medicare tax from employees paychecks or who must pay the employers portion of social security or Medicare tax. These organizations include charitable religious scientific and other organizations described in section 501c as well as employees trusts forming part of pension profit-sharing and stock bonus plans described in section 401a.

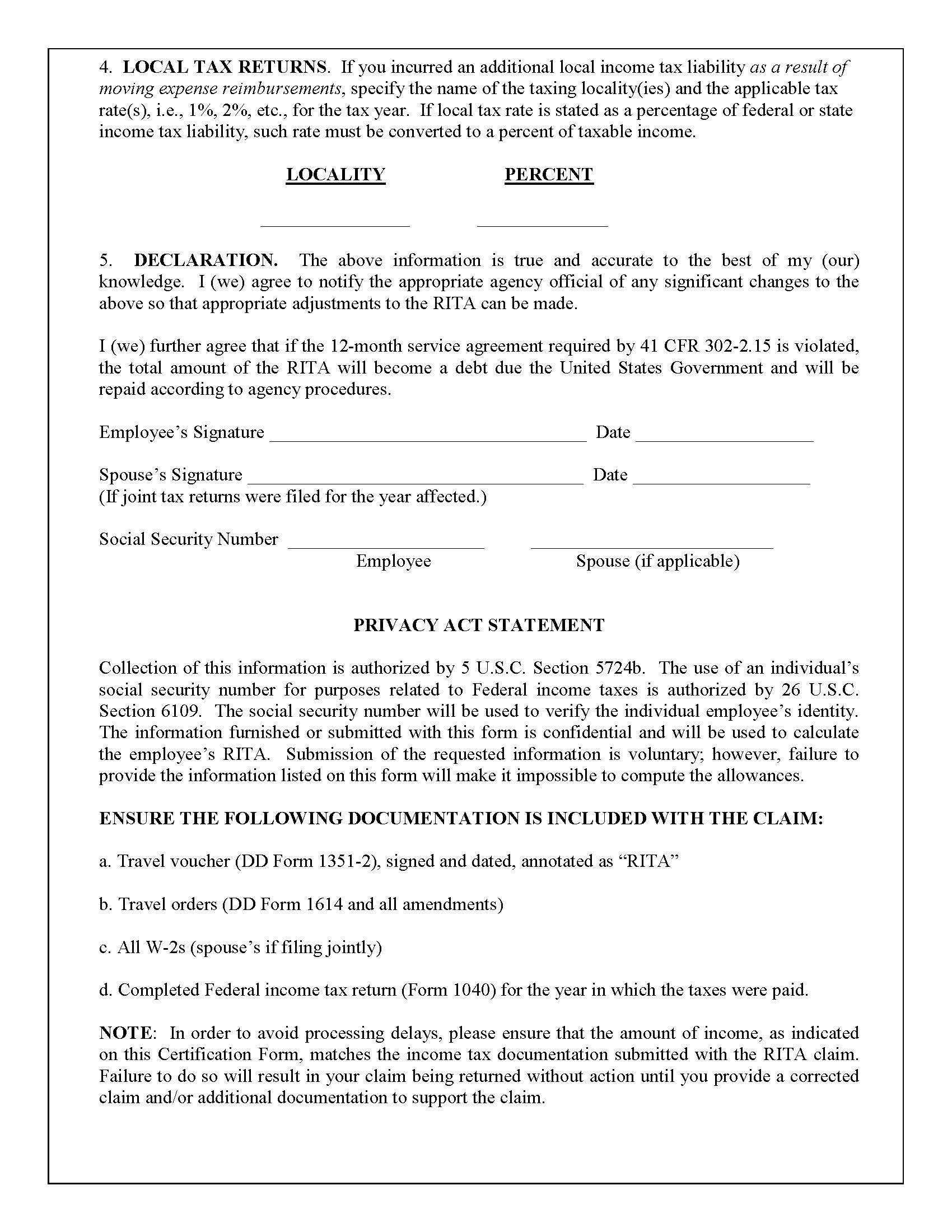

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

Ethiopian Income Tax Declaration Form Fill Online Printable Fillable Blank Pdffiller

Tax Information For International Students International

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

Section 3 Introduction To The Canada Revenue Agency Cra Canada Ca

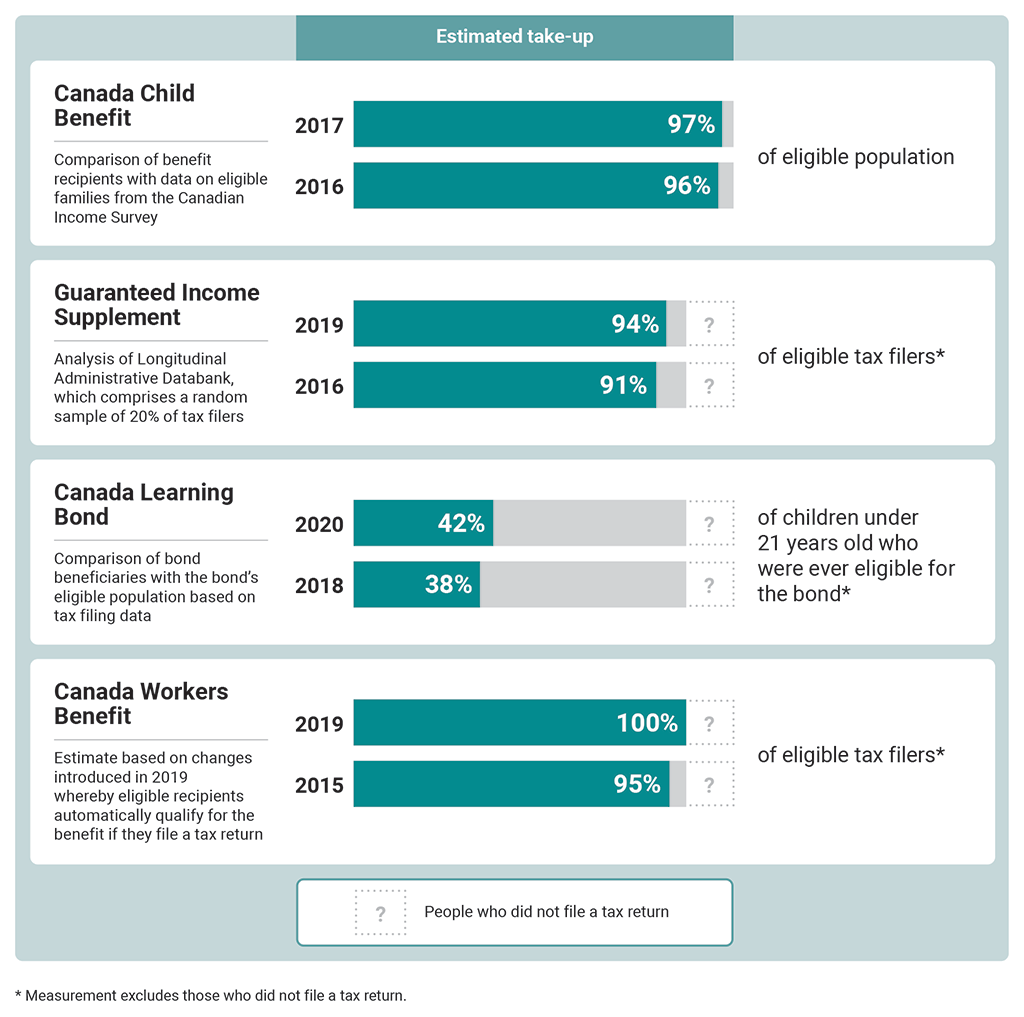

Report 1 Access To Benefits For Hard To Reach Populations

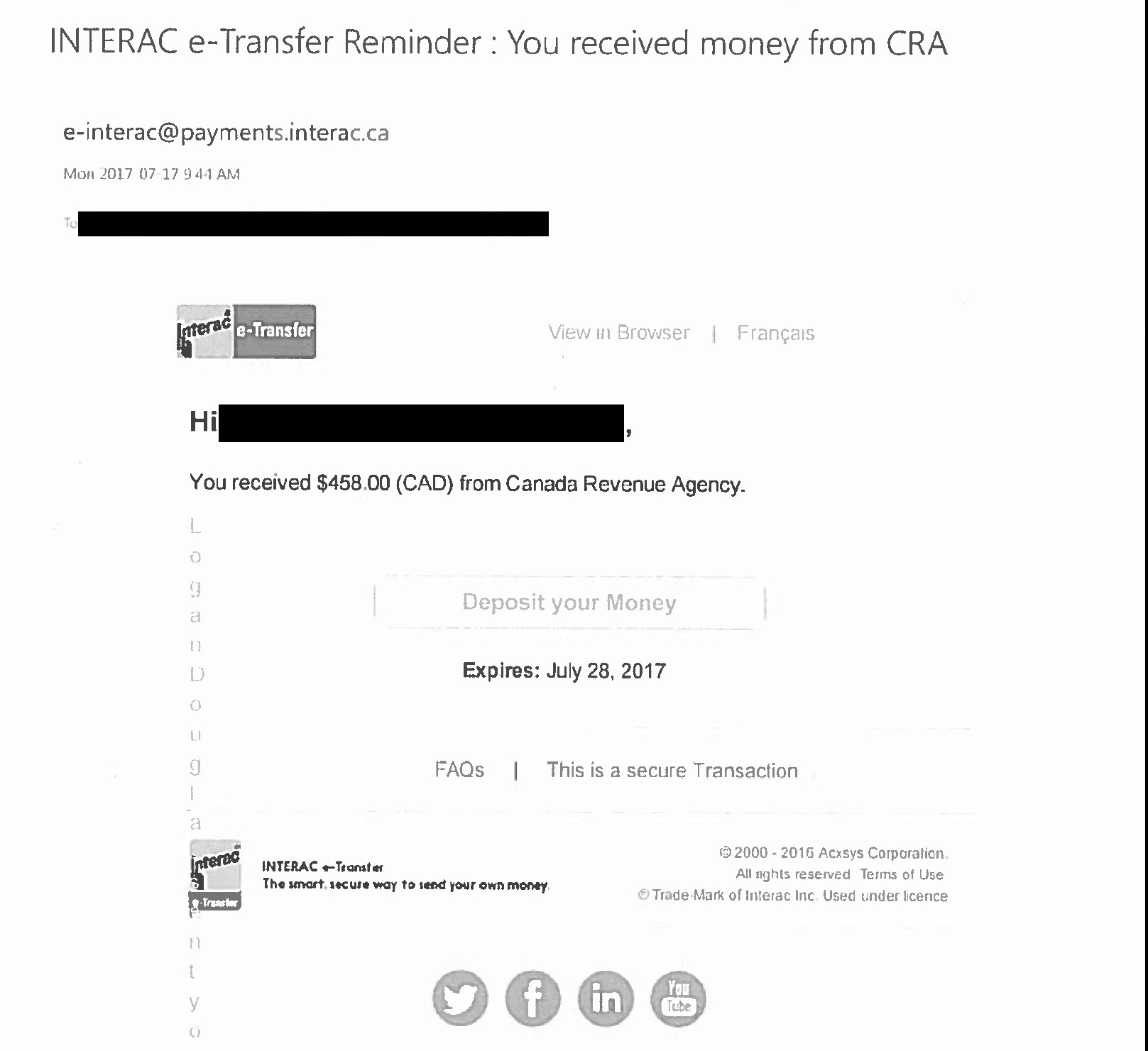

Samples Of Fraudulent Emails Canada Ca

How To File An Income Tax Return In Spain Expatica

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Individuals Filing Due Dates Regional Income Tax Agency

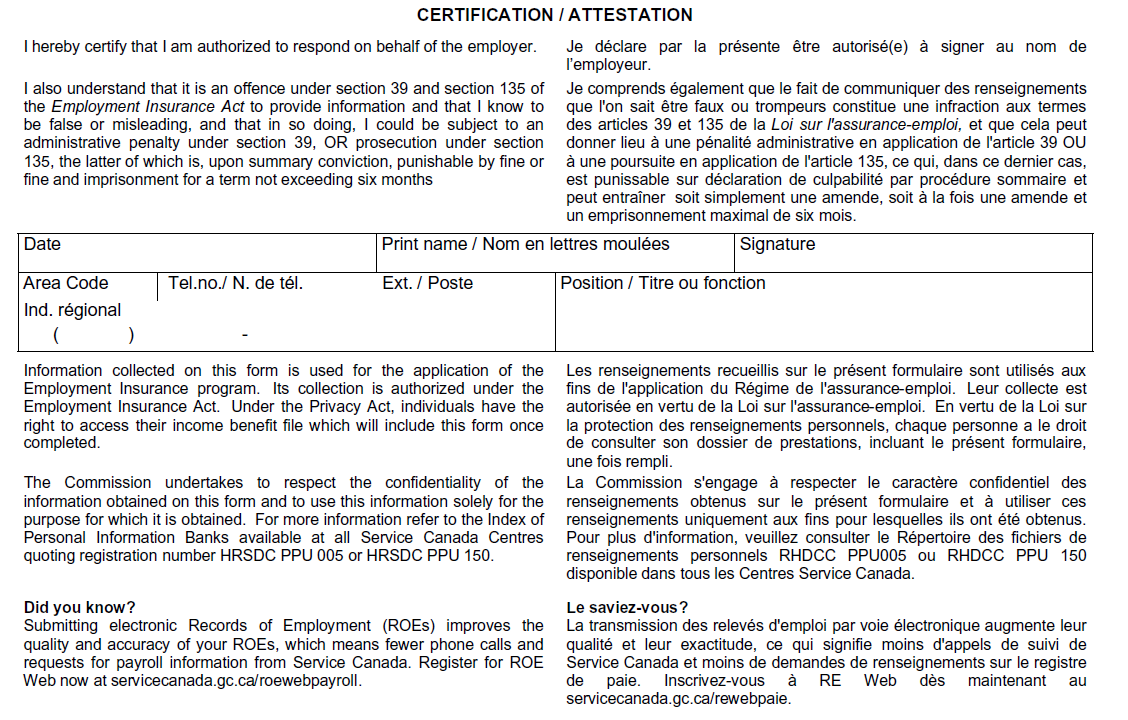

Request For Payroll Information Forms Canada Ca

Income Tax City Of Gahanna Ohio

Income Tax City Of Gahanna Ohio

Income Tax City Of Gahanna Ohio

T1 Vs T4 Tax Form What S The Difference

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita